Avoid These Common Mistakes When Opening a Bank Account

Opening a bank account sounds like a straightforward step toward managing your personal finances, but many people make easily avoidable mistakes during the process. Whether it’s your first time opening an account or you’re switching banks, being informed can save you time, money, and future inconvenience. Let’s take a look at some of the most common mistakes you should steer clear of when opening a bank account.

1. Not Comparing Banks and Account Types

One of the biggest errors is not shopping around. Banks and credit unions offer a variety of accounts, each with its own fees, benefits, and requirements. Simply going with the most convenient option may mean missing out on better interest rates or lower fees elsewhere.

Tip: Take the time to look at both traditional banks and online banking options. Online banks often offer better savings rates and lower fees due to reduced overhead.

2. Ignoring Monthly Maintenance Fees

Many banks charge monthly maintenance fees if you don’t meet certain criteria like maintaining a minimum balance or setting up direct deposit. Failing to understand these conditions can lead to unnecessary charges.

Before opening an account, ask:

- Is there a monthly fee?

- What are the conditions to waive it?

- How does the bank notify customers of fee changes?

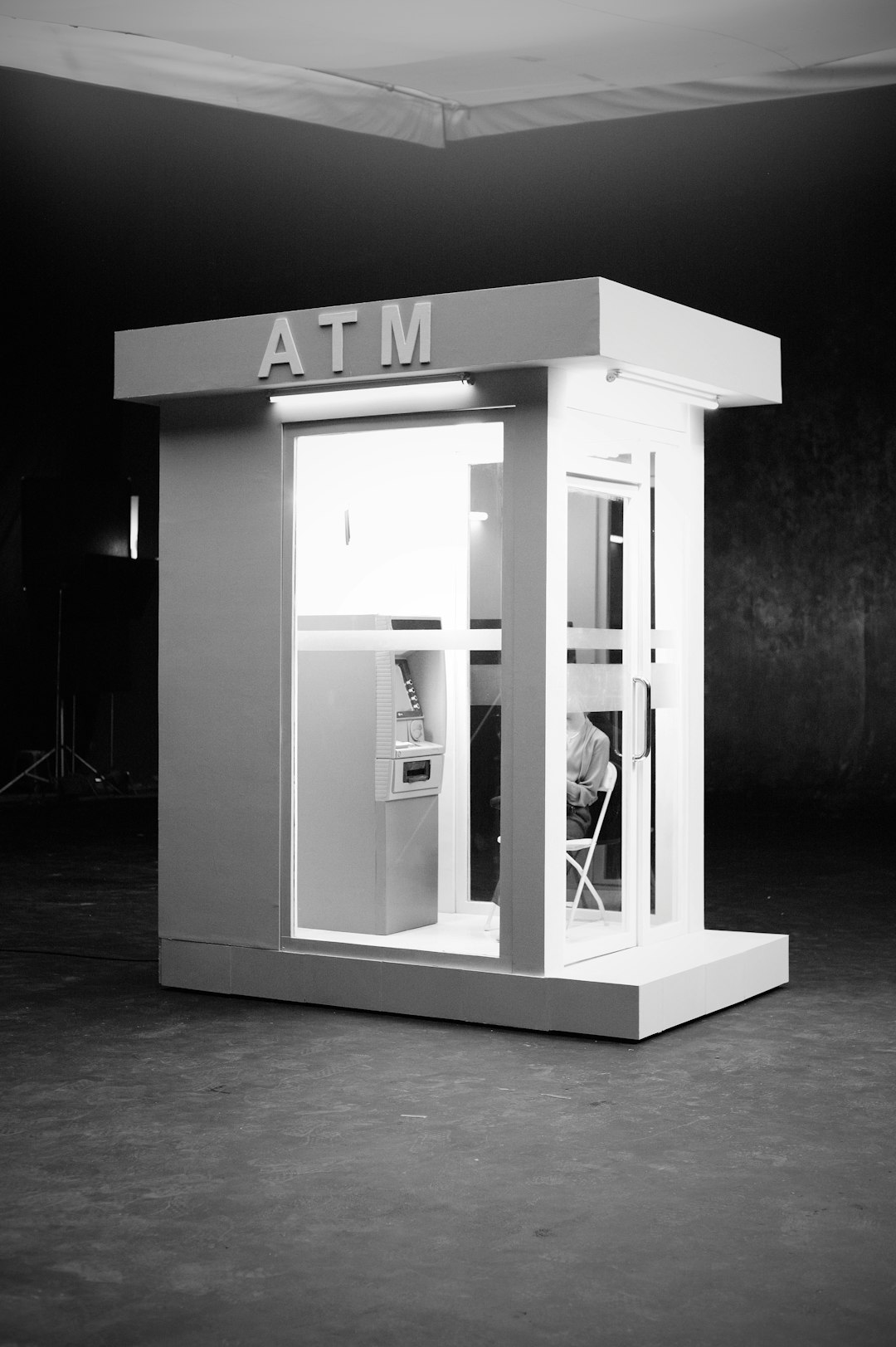

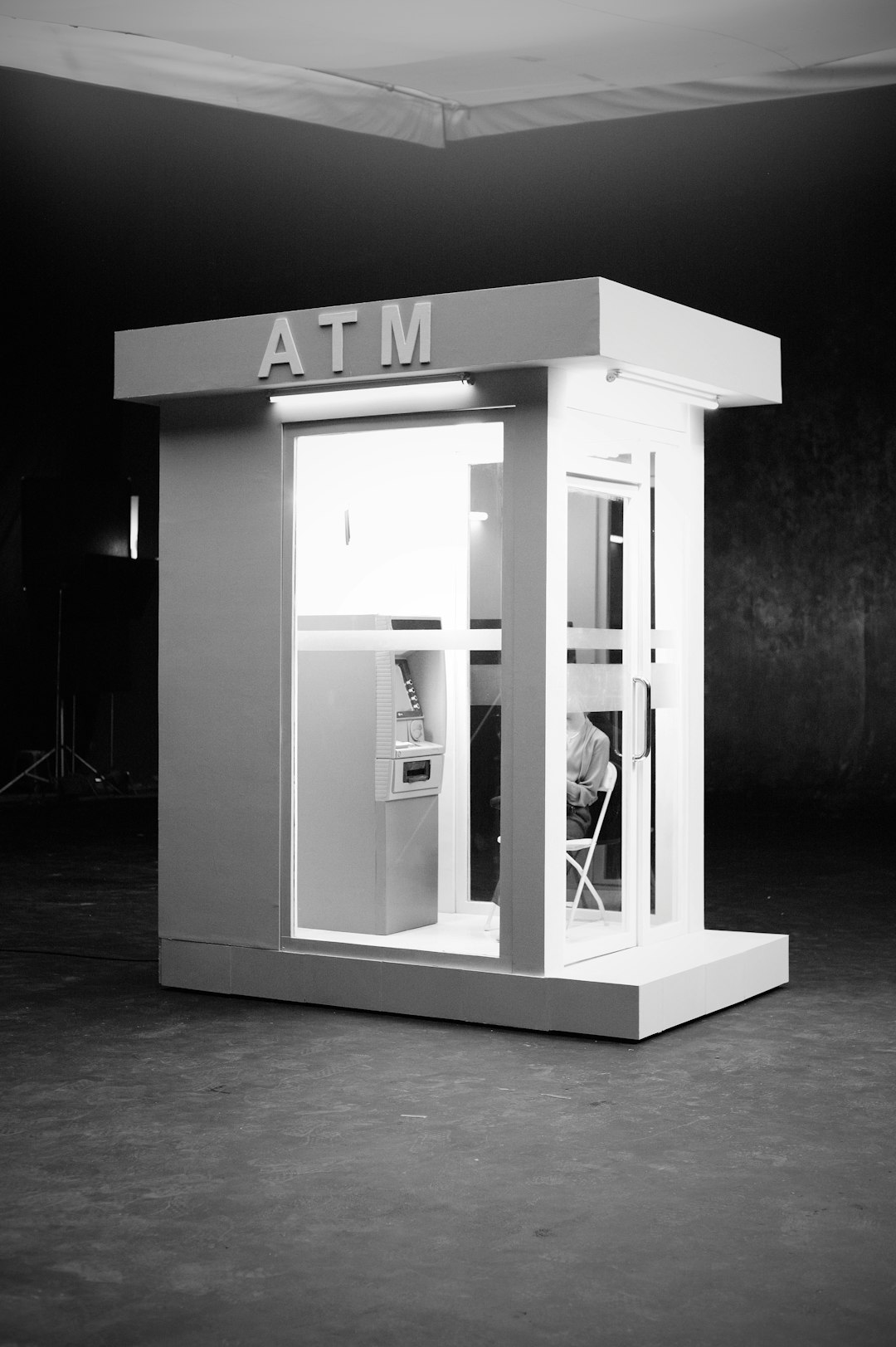

3. Not Reviewing ATM Access and Fees

ATM accessibility is essential, especially if you need frequent cash withdrawals. Overlooking ATM fees can quickly become costly. Using an out-of-network ATM can incur fees both from your bank and the ATM operator.

Make sure to check:

- How many ATMs are in your area or network?

- Does your bank reimburse ATM fees?

- Are there partner banks you can use for free?

4. Failing to Understand Overdraft Policies

Many people assume their purchases won’t go through if they don’t have enough money in their accounts. However, some banks allow transactions to proceed and then charge overdraft fees, which can add up quickly.

Important: Always read the overdraft policy before opening an account. Understand how the bank handles insufficient funds and whether they offer overdraft protection options.

5. Overlooking Online and Mobile Banking Features

Modern banking requires convenience and accessibility. Unfortunately, not all banks offer quality digital services. Neglecting to test or assess a bank’s online platform might leave you frustrated later.

Look for the following features:

- Ease of mobile app navigation

- Mobile check deposit

- Alert systems for balances and transactions

- Bill-pay and account transfer capabilities

6. Skipping the Fine Print

It’s tempting to rush through the account opening process and skip the fine print, but doing so can lead to unpleasant surprises. From hidden fees to restrictive account closing procedures, the terms and conditions provide crucial information.

Best Practice: Take the time to read the disclosures provided, and don’t hesitate to ask questions if something is unclear.

7. Not Setting Up Proper Alerts and Notifications

Once you open your bank account, it’s vital to set up notifications for low balances, withdrawals, and suspicious activity. Many people fail to do this and miss early warning signs of fraud or overspending.

Configure alerts through the bank’s online portal or mobile app. These can dramatically increase your financial security and awareness.

8. Forgetting to Link External Accounts

If you have multiple accounts (e.g., savings, investments, checking), linking them can make transferring funds easier and help meet balance requirements to avoid fees. Not linking accounts might lead to penalties or missed opportunities for automatic bill payments.

9. Disregarding Future Banking Needs

Think beyond just checking and savings. Will you need a car loan, mortgage, or business services in the future? Choosing a bank that offers a full suite of products can simplify your financial life down the road.

The Bottom Line

Opening a bank account is more than just signing forms. By avoiding these common mistakes—such as ignoring fees, not comparing options, or overlooking digital features—you’ll be better positioned to manage your money effectively and hassle-free.

Take your time, ask the right questions, and remember that your bank should work for you—not against you.