HIPAA Compliant Credit Card Processing in 2025

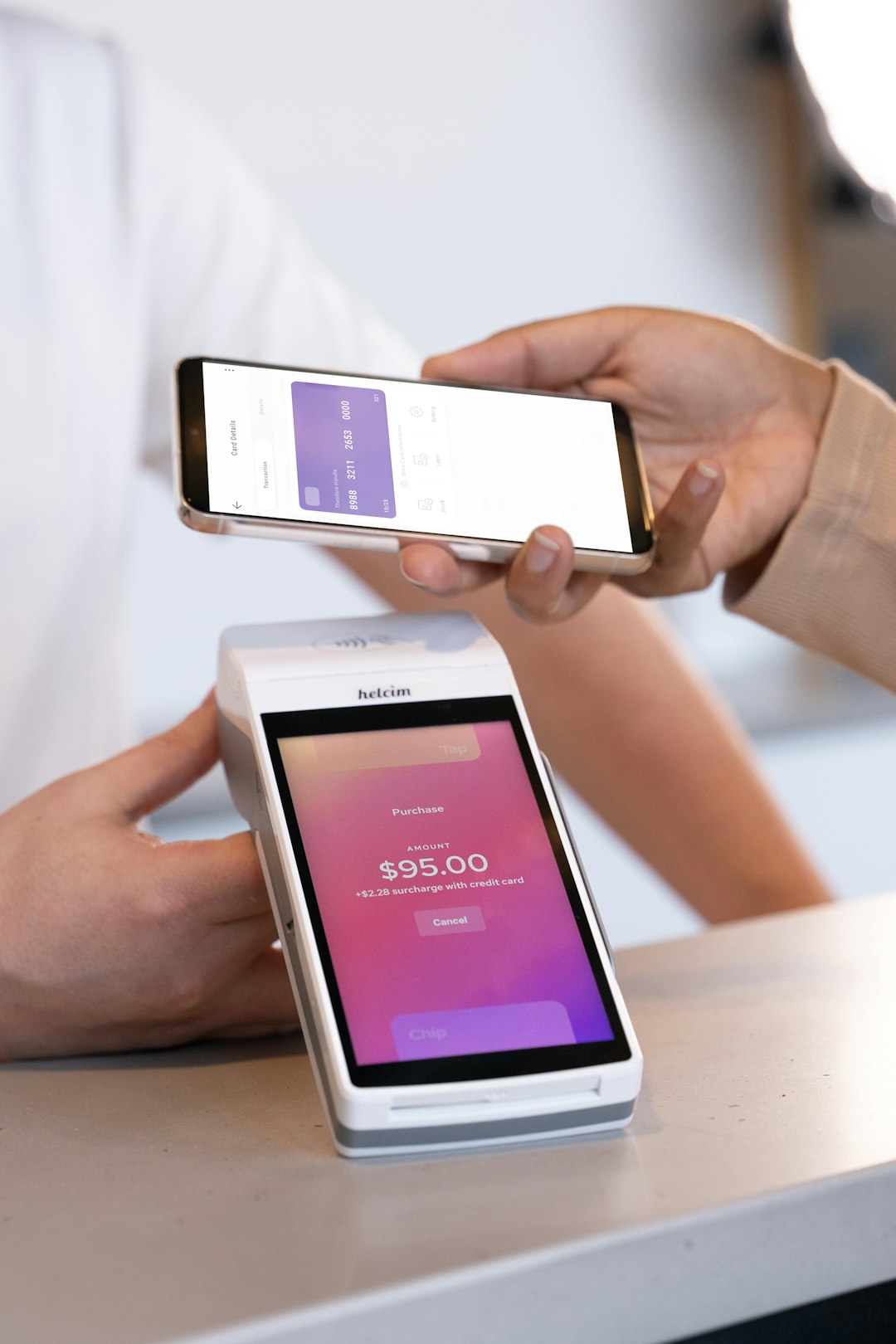

As the healthcare industry continues to evolve, compliance with privacy and security standards has become more crucial than ever. One of the key areas demanding more attention in 2025 is HIPAA compliant credit card processing. With the increase in digital payments and medical services offered online, healthcare providers are under growing pressure to ensure that every transaction complies with the Health Insurance Portability and Accountability Act (HIPAA).

For medical clinics, dental offices, telehealth providers, and even pharmacies, handling electronic payments means more than just standard PCI DSS compliance. When Protected Health Information (PHI) is tied to a payment, merging financial transactions with health data necessitates strict adherence to HIPAA regulations.

The Intersection of HIPAA and Payment Processing

A key challenge in 2025 is the intersection between patient privacy laws and the technical requirements of processing payments. HIPAA was originally crafted to protect sensitive patient health information, but with the growing reliance on integrated billing systems, the scope of compliance has widened considerably.

Healthcare organizations must understand that not every payment processor is HIPAA compliant. Unlike retail businesses, medical practices deal with payment information that may also be linked to appointment records, diagnoses, or prescribed treatments — all of which are considered PHI under HIPAA.

What Makes a Payment Processor HIPAA Compliant?

In 2025, being HIPAA compliant means more than just secure technology — it involves administrative, technical, and physical safeguards. Here’s what to look for when selecting a compliant payment processor:

- Business Associate Agreements (BAA): Any third-party service provider handling PHI must be willing to sign a BAA, making them legally accountable for HIPAA compliance.

- End-to-End Encryption: All payment and health data must be encrypted during transmission and storage.

- Data Segmentation: Payment solutions must securely separate PHI from payment information wherever feasible.

- Audit Logs: Systems must maintain detailed, unalterable logs of who accessed data and when.

- User Authentication: Strict user ID protocols and access controls must be enforced across all endpoints.

Providers must also train staff on how to handle patient payments securely and maintain privacy when using digital devices such as tablets or self-service kiosks.

Benefits of HIPAA Compliant Solutions

Adopting HIPAA compliant credit card processing isn’t just an obligation — it can improve efficiency, build patient trust, and reduce the risk of costly data breaches.

Some of the prominent benefits include:

- Medical billing and payments can be integrated more seamlessly.

- Patients feel more confident sharing sensitive information.

- Winning protection from legal action or fines by avoiding preventable HIPAA violations.

Digital Trends Driving Compliance Needs in 2025

This year, healthcare providers are experiencing surges in online consultations and remote billing. As this shift continues, so do the risks related to insufficient security of digital transactions.

The rise of mobile health (mHealth) apps and patient portals has led to payment processing solutions embedded directly into digital platforms. Using APIs and cloud-based services, modern clinics can streamline the payment experience — but only if they ensure compliant architecture.

Additionally, artificial intelligence and automation tools now play a larger role in billing. In this climate, HIPAA compliance must be embedded not only into payment systems but also the entire data lifecycle associated with patient financial interactions.

FAQ: HIPAA Compliant Credit Card Processing

- Do all payment processors need to be HIPAA compliant?

-

Only if they handle PHI as part of the transaction or system. Payment processors that interact solely with financial data are bound by PCI DSS, but if PHI is involved, HIPAA compliance becomes necessary.

- What is a Business Associate Agreement (BAA)?

-

A BAA is a legal contract between a healthcare provider and a vendor stating that the vendor will handle PHI in a compliant manner under HIPAA regulations.

- Can I use Square, Stripe, or PayPal in my healthcare practice?

-

Some of these platforms do not offer BAAs by default. Only use processors that explicitly state HIPAA compliance and provide a BAA.

- Is PCI DSS compliance enough for healthcare payment solutions?

-

No. While PCI DSS handles payment card security, HIPAA addresses PHI. A dual-compliance approach is required when PHI is involved.

- How do I verify if a payment processor is HIPAA compliant?

-

Request documentation, confirm their willingness to sign a BAA, and inquire about their security protocols and data handling practices.

With an increasing number of digital tools managing both patient information and transactions, healthcare organizations must be vigilant. By choosing HIPAA compliant credit card processing solutions in 2025, providers not only protect sensitive data but set the foundation for secure and efficient healthcare delivery.